No matter what mix of financial aid you receive, you, your parents and UC each has an important role in paying for your education:

- Students: UC expects you to cover part of the cost of attendance through working and borrowing. UC also expects you to apply for all available financial aid programs for which you are eligible by completing the FAFSA if you are eligible for federal aid, or the California Dream Act Application if you are undocumented, a U Visa holder, or under Temporary Protected Status (TPS).

- Parents: UC expects parents to contribute based on their financial resources and circumstances as reported on the FAFSA or California Dream Act Application.

- UC covers the remaining costs with gift aid from a variety of sources. Each campus determines your total grant eligibility and meets it using federal, state and UC's own gift aid programs.

To get a better understanding of how this all works together, it's helpful to understand the following equation:

Total cost of attendance: The total cost of attendance is UC’s estimate of your annual budget while attending UC. This figure is based on information you provide in the financial aid application and includes tuition and fees, as well as books, housing, food and other living expenses.

Gift aid (free $): Think of gift aid as free money that you can use to cover your educational expenses. Grants and UC scholarships fall into this category and help cover your cost of attendance (which includes tuition and fees, room and board, books and supplies, health insurance, transportation, and personal expenses).

Net cost: The net cost — the portion you and your parents have to pay — is the total cost of attendance (or “sticker price”), minus the gift aid you receive. This amount is the most important factor to consider when you compare your UC financial aid offer to offers from other colleges.

Paying the net cost

Student contribution

UC expects every undergraduate seeking financial aid to help cover his or her net cost through a manageable combination of work and borrowing. This is what we call self-help aid: a combination of loans and wages earned from jobs during the academic year and summer.

Parent contribution

The amount your parents are expected to pay is determined based on information you provide on the FAFSA or California Dream Act Application. For very low-income families, there may be no parent contribution expected.

Some families use a combination of current earnings and savings to cover their share. For many families, though, the combination of savings and earnings isn't enough to cover all their net costs. In these cases, families can explore student and parent educational loans.

Students who are deemed to be financially independent from their parents have no expected parent contribution.

How does it all fit together?

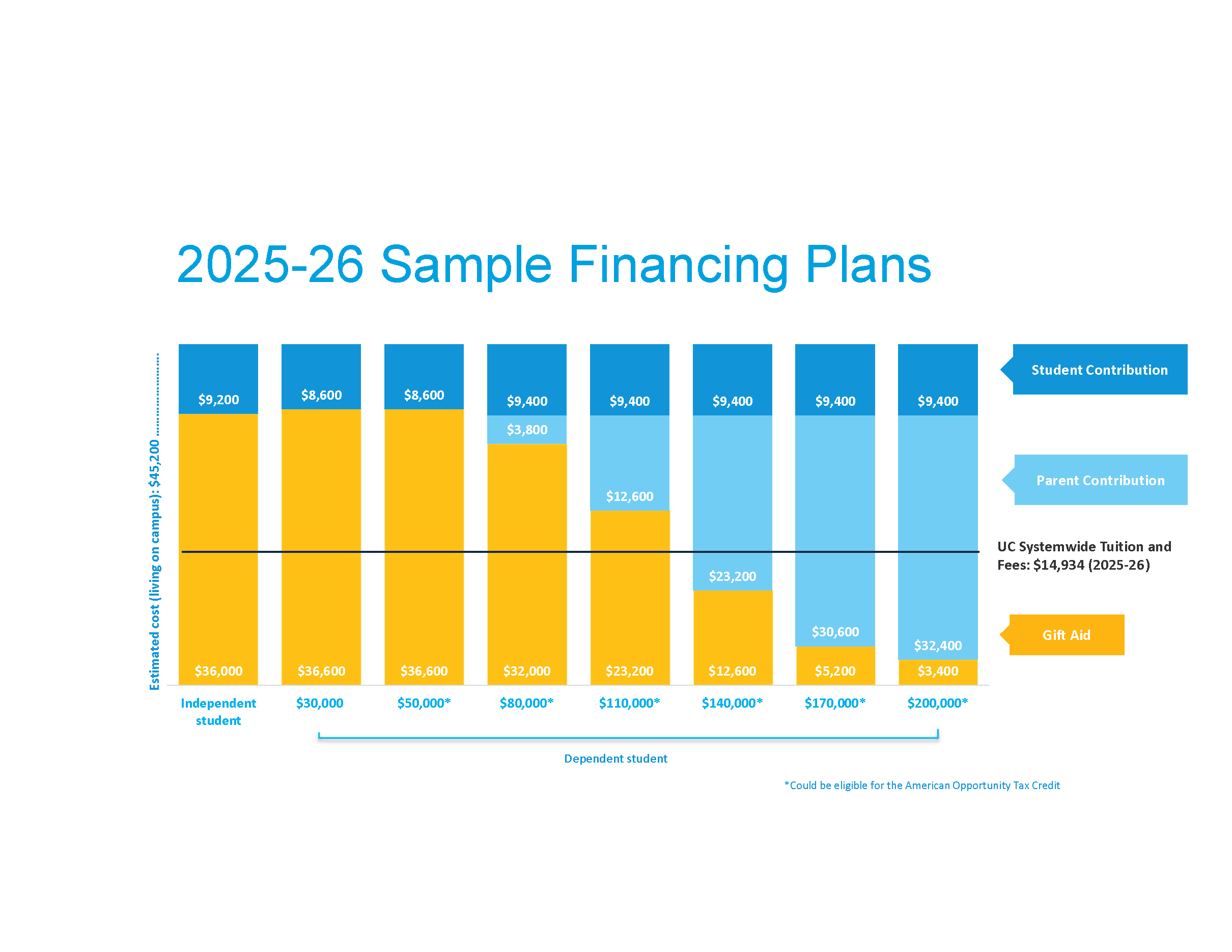

The chart below shows how financial aid fits together with parent and student contributions to cover the total cost of attending UC.

It serves only as a guide to understanding your educational expenses, as cost of attendance and financial aid availability change year to year, campus to campus.

You may notice a few things from the chart above:

- Students from low-income families and financially independent students are more likely to receive gift aid and larger awards than students from higher-income families.

- The more gift aid awarded, the less students and parents need to contribute through savings, income or loans.

- The higher the income level, the higher the expected parent contribution.

- Estimated cost includes living on campus; the cost for students who live off campus may be lower.

Remember, even students without financial need can apply for financial aid. Though over 90% of gift aid received by students is awarded on the basis of need, a large proportion of students at every income level receive some form of gift aid.